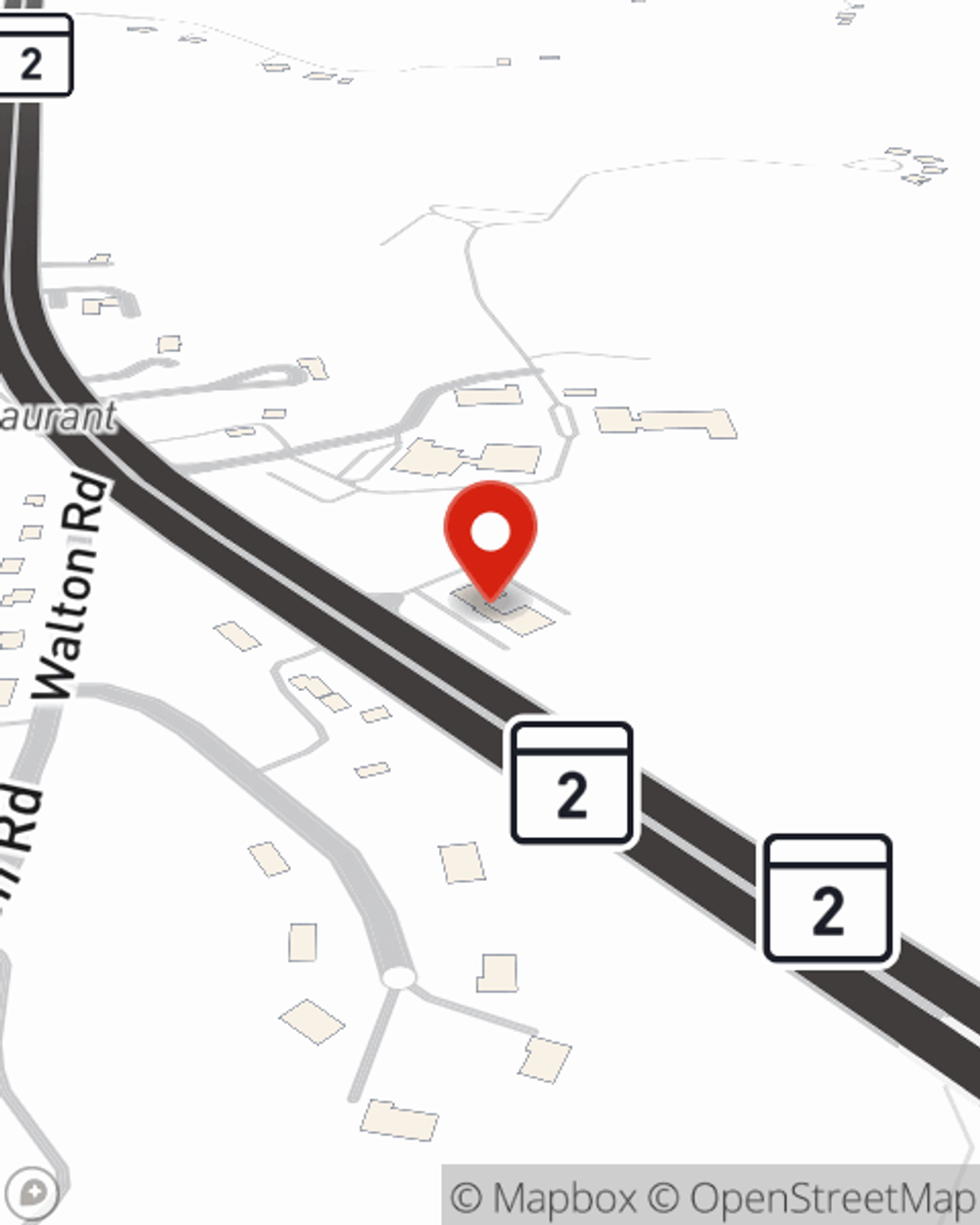

Life Insurance in and around Huntingtown

Insurance that helps life's moments move on

What are you waiting for?

Would you like to create a personalized life quote?

- Huntingtown

- Prince Frederick

- Dunkirk

- Chesapeake Beach

- North Beach

- Lusby

- Saint Leonard

- Owings

- Sunderland

- Port Republic

- Solomons

- La Plata

- Lothian

- Deale

- California

- Hollywood

- Rosedale

- Davidsonville

- Edgewater

- Hughesville

- Charlotte Hall

- King George

State Farm Offers Life Insurance Options, Too

When you're young and your life is ahead of you, you may think you don't need Life insurance. But it's a perfect time to start looking into Life insurance to prepare for the unexpected.

Insurance that helps life's moments move on

What are you waiting for?

Their Future Is Safe With State Farm

Cost is one of the biggest benefits of getting life insurance sooner rather than later. With an insurance policy from State Farm, you can lock in terrific costs while you are young and healthy. And your policy can be good for more than a death benefit. Learn more about all these benefits by working with State Farm Agent Ed Paton or one of their caring representatives. Ed Paton can help design an insurance policy aligned with coverage you have in mind.

If you're a person, life insurance is for you. Agent Ed Paton would love to help you discover the variety of coverage options that State Farm offers and help you get a policy that works for you and the ones you love most. Reach out to Ed Paton's office to get started.

Have More Questions About Life Insurance?

Call Ed at (301) 868-5151 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

Simple Insights®

How to use life insurance to help a special needs child or adult

How to use life insurance to help a special needs child or adult

From life insurance to a special needs trust, here's what you need to know to keep your loved one financially secure.

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.